Guide to borderless banking for Estonian e-Residents

on August 18, 2022 • 8 minute read

E-Residency in Estonia has shaken up the way the world does business, and enabled location-independent entrepreneurs to offer products and services in countries where they do not reside, thanks to Estonian’s unique digital infrastructure.

However, most business activity involves money, and that requires banking services. It’s always been a fact of life, that technology changes faster than statutory regulation, and international financial institutions are a good example — grounded in legacy local systems and myriad currencies, banking remains unevenly distributed around the world in so many ways. So, what does this mean for e-residents, who need to transact with clients in different markets and currencies?

Today there are a range of possibilities available for new e-resident businesses to consider, from simple payment gateways to full clearing bank solutions. Which you opt for depends on what your unique e-business needs.

Benefits of cross-border banking for Estonian e-residents

Many entrepreneurs opt for Estonian e-resident status precisely because of its international outlook, and the digital infrastructure which enables commerce with clients all over the world. The e-Residency program has been created to support this, and to ensure that e-residents have the tools and channels they need, to operate in an entirely location-independent way.

Cross-border banking with an Estonian clearing bank is a great solution for entrepreneurs seeking to operate across different currencies and jurisdictions, and the benefits include:

- Access to international SWIFT/BIC system

- Access to investment accounts and products

- Free of charge SEPA payments and deposits

- Business debit and credit cards

- Secure online banking

- Access to credit, loans, and overdraft facilities

- Interest-earning deposit accounts

- Deposits protected by the Financial Services Compensation Scheme (FSCS), up to a value equivalent to €100,000

However, the commercial banks in Estonia are independent of the state, and have their own criteria for choosing whom to take on as customers. Furthermore, they are subject to binding EU-wide regulations, such as ‘know your customer’ (KYC) and 'Anti-Money Laundering' (AML) compliance procedures, required by law, to mitigate the risks of banks and financial services companies being used as vehicles for financial crime.

This has led to some challenges for e-residents in the past, because the AML culture in international banking can lead to automatic suspicion of the motives of non-residents seeking to open a local account. With the onus on the institution to establish beyond doubt that all funds they handle are completely “clean” and genuine, some simply prefer not to deal with non-Estonian customers at all — international banking is to a great extent based on trust, between correspondent institutions in different countries operating under different legal frameworks, and ultimately, they make their own decisions regarding their choice of customers. Those Estonian banks who will offer services to international residents therefore require a face-to-face meeting for KYC purposes, before deciding on whether an account can be opened.

Also, like banks all over the world, there are fees payable — to open the account in the first place, and then small regular fees for account maintenance and card provision (for example, €2 per month for the LHV Business Debit Mastercard.)

LHV is the most commonly used bank in Estonia for e-residents, because they have always been open to serving single shareholder companies with easily traceable income. Recently, Coop Pank joined the e-Residency marketplace of service providers too, so there are alternative options to consider, alongside a growing number of alternatives (see below).

Banking your e-resident business elsewhere in the EEA

If borderless banking within Estonia is not right for you, it’s worth considering an account in a different EEA nation, perhaps where you are fiscally resident.

Estonia amended its commercial code in 2019 to allow entrepreneurs to register a share capital contribution with an account at an EEA credit or payment institution. So, if you already have a business relationship with a local bank, you could discuss the possibility of their accepting your new Estonian business as a client.

This would give you access to credit lines and other business banking advantages, without having to travel to Estonia for KYC. However, you obviously would not be able to use your Estonian e-resident digital ID to manage business banking transactions, and your IBAN will be from a different jurisdiction (which could lead to confusion, or even IBAN discrimination.)

Meanwhile, there are other benefits to being part of the Estonian culture of innovation, and one of these is the existence of alternative solutions for business transactions.

Fintech solutions for e-Resident businesses

A decade or two past, operating an international business without the support of a traditional bank would have been unthinkable. However, today, there are other options, at least for those Estonian e-residents who are personally resident in the UK or EU.

Benefits of fintech solutions for e-resident entrepreneurs

- No waiting! Set up your account in hours instead of days/weeks

- Automated KYC - you’ll usually need to upload copies of ID and proof of address, but you won’t have to visit any branch for a face-to-face meeting

- Great user experience, especially slick mobile apps - as fintechs originate from the tech world rather than banking, and design around the customer

- Regulated activity - by the FCA and others. While you might not have the guarantees of a banking licence, you do have statutory protections

- Rapid transactions, often based on mobile identifiers rather than entering IBANs

- Multi-currency accounts and conversions, for anyone transacting globally

The fintech Wise was formerly an Estonian startup known as TransferWise, created to enable low-cost peer-to-peer currency conversions. Today, Wise Payments Limited is authorized as an Electronic Money Institution (EMI) by the UK Financial Conduct Authority (FCA), and has evolved into a highly functional non-bank payment provider.

This means your Wise account is an electronic money account rather than a bank account, so it does not offer the savings and lendings services of a bank, nor is it covered by the deposit guarantee scheme. Wise safeguards customer assets in international clearing banks around the world (including LHV Pank in Estonia.) You cannot earn interest, obtain a loan, or arrange an overdraft, with Wise.

So, Wise is not a place to accumulate capital, and indeed they have recently introduced a fee for holding deposits in personal accounts greater than €3000 (as interbank € interest rates have seen negative territory this year). This caused indignation in many digital nomad forums, a fact which can in many ways this can be seen as a testament to Wise’s user experience, indicating that many people simply regard it as their cross-border go-to for day-to-day banking services — including the use of a debit card for cash and payments.

And for business, Wise’s biggest advantage is the support of up to 10 local bank details sets, enabling the acceptance of payments ‘like a local’ from your customers around the world (in over 50 currencies), at the real exchange rate (subject to a low fixed fee, rather than a commission or rate arbitrage.) This represents huge savings for e-resident entrepreneurs who receive payments in different currencies, and helps them to provide a straightforward and easy way to get paid in the first place — often blazingly fast, thanks to the UK’s Faster Payment Service (FPS.) But, it’s important to realize these local bank details (like 8-digit account numbers + sort codes for UK customers, or ACH details for US), are virtual, rather than actual, accounts.

There are other fintech solutions to explore as well, including Revolut Business, Monzo, and Starling. These are all EMIs rather than banks, but include a range of services which are highly useful to business operations, such as payroll support and integrated accounting software, as well as currency exchange.

They all charge fees in different ways, and offer different user experiences (including mobile apps, which are frequently better designed than those of traditional banks, being natively digital services.)

Payment gateways and other considerations for e-resident businesses

For many online business owners, there are also payment gateways to consider, if you’re accepting fees from online sales and services. These include PayPal, Stripe, and remittances from portals like Amazon.

These are not alternatives to banks, but a smooth integration with your business banking is essential, and there are sometimes unexpected limitations. For example, PayPal currently only accepts Revolut Business accounts from the following countries: United Kingdom, Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain. So, Danish or Hungarian e-Residents could find themselves unable to move funds to meet a payment need…

Other payment gateways include Payoneer, Paysera, and your Estonian e-compatriots Payhawk, as well as Wamo, Intergiro, and Juni — so you need to dig through the small print of each, and decide what will work best for you, bearing in mind the way you intend for your business to grow, as well as your immediate needs for services.

How to choose the best business banking stack for your Estonian e-resident business

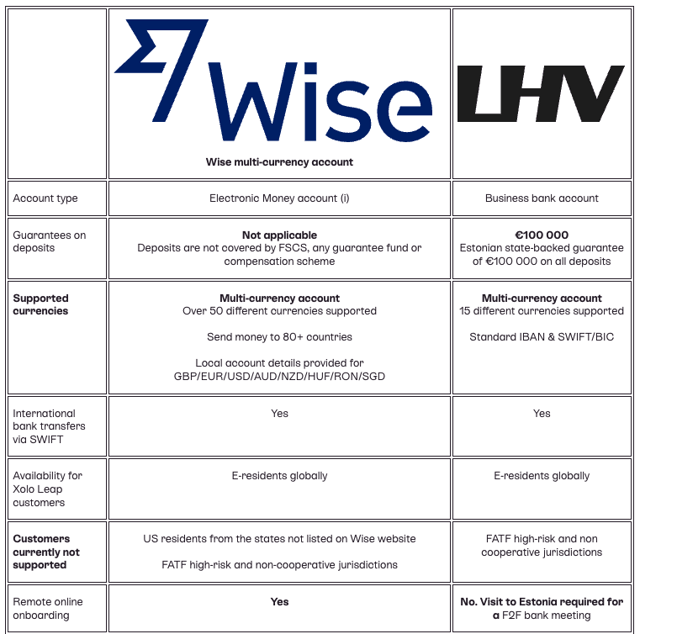

How do you decide which is right for YOUR Estonian e-resident business? This detailed comparison of the services of Wise and LHV might help you choose between the two, But, it can also help you to explore how they can best work together to serve your cross border banking needs:

The entire Wise and LHV comparison table is available on our FAQ page.

You will need to compare the different services carefully, as well as exploring the best way to maintain an overview of your business’s complete financial picture — which is where integrations come into play.

Furthermore, you will have to consider speed, and costs. Fintech accounts can be set up extremely fast, and do not require a face-to-face KYC meeting, so you can get going (and raise your first invoice) as quickly as possible. Opening a fully featured business bank account is a more involved process, even with Xolo’s support (see below.)

Many entrepreneurs find it helpful to consider their business money management in workflow terms, in the same way that they might evaluate the technology they use to innovate or collaborate. The ideal solution may involve a combination of integrated services — such as: Stripe for online content sales, connected to the main business bank account and reconciled monthly, while using Wise for non-Euro invoicing and receipts.

In addition, you may decide your business plan involves the prompt establishment of a Wise account and PayPal ASAP to support immediate transactional needs, while planning to visit Estonia and open an account with LHV or other local bank when time and resources permit.

Xolo’s business banking integrations for e-resident businesses

Xolo Leap customers enjoy a clear snapshot of their cash position across all accounts, including banks, fintechs, and payment gateways, in the business dashboard.

This is supported by native integrations and application programming interfaces (APIs), that you don’t need to think about thanks to automation — though from time to time, you may need to authorize or reauthorize Xolo to access and display this information for you.

And remember, Xolo’s customer needs are central to our product development roadmap - so if there’s a banking or payment integration that would be useful for you, be sure to let us know.

Xolo and LHV — the ultimate borderless banking solution for e-residents of Estonia

Xolo has a close relationship with LHV bank in Tallinn, which has helped many e-Residents establish their business banking presence as frictionlessly as possible, and enjoy the benefits outlined above for operating a fully-fledged business account with an international clearing bank.

Xolo’s support for LHV onboarding includes pre-filled application forms AND pre-acceptance for a business bank account, before you book your flight ticket to Estonia (or even submit personal documentation.) You do still need to attend that meeting in person, but you can do so with confidence, and at your convenience — perhaps taking the time to explore beautiful Tallinn, and meet up with other like-minded business owners and entrepreneurs.

Once your LHV account is open, the native API between Xolo and LHV mean that all payments are reconciled in real time, so your dashboard shows an accurate snapshot of your cash position across all currencies. Furthermore, your Xolo support team have direct access to your account, in order to set up payments on your behalf for you to sign off. They can NOT make the payments, as this remains under your personal control, via your EID access codes — but they can ensure that payments such as VAT are correctly calculated and referenced, so all you have to do is log in and authorize them when promoted to do so.

Xolo and Wise integration

Wise also integrates smoothly with the Xolo dashboard, and requires only a simple reauthorization periodically, to maintain the connection.

This makes it easy to see your position across different currencies, which is critical for any entrepreneur operating with both clients and suppliers in different markets — particularly in these days of fluctuating rates and geoarbitrage.

Furthermore, it is easy to integrate your different currency Wise accounts into your sales dashboard, associating each customer with their preferred ‘local’ bank details. Every time you raise an invoice with their name on it, payment information in their native currency and format is included — so they have no excuse not to pay you promptly, and without either side incurring additional fees.

Still unclear about the best options for your Estonian e-resident business banking?

Yes, it is complicated. But don’t worry — Xolo is here to help you.

From the outset, you just need a way to make payments, and to get paid — so that you can get on with earning the money in the first place.

You can always add new account and payment options later on as your business becomes established, you start to consider share capital, and you get clarity on exactly what your customers need from you (and what you need from a service provider.)

Furthermore, new payment service providers are being added to the e-Residency marketplace all the time, so you might find the ideal partner for your business is just getting started! Whatever happens, you can count on Xolo to offer you the best business banking solutions for your cross-border e-resident business, at all times.

About Maya

Maya Middlemiss is a freelance journalist and author, excited about the future of work, business, money, and technology. She operates her e-resident business through Xolo Leap, so that she can work frictionlessly with brands and publications all over the world, and she is the host of the Future is Freelance podcast. Exploring the social impact of technology on our changing world, and bringing those stories to life in an accessible and inclusive way, is her passion — because all of this is far too exciting to leave it to the geeks. Maya is a 'digital slowmad', originally from London, presently living with her family in Eastern Spain.

Related blogs

Subscribe to a weekly blog roundup

Get the best business tips from Xolo and our community of freelancers straight to your inbox